Introduction

There are many components of having a Go To Market (GTM) proposition that will either make or break your chances of securing growth funding and avoiding the often heard sweeping phrase by entrepreneurs that ”if we only get x% of this zillion dollar market we’ll hit our numbers!” This statement has rendered many pitches fruitless!

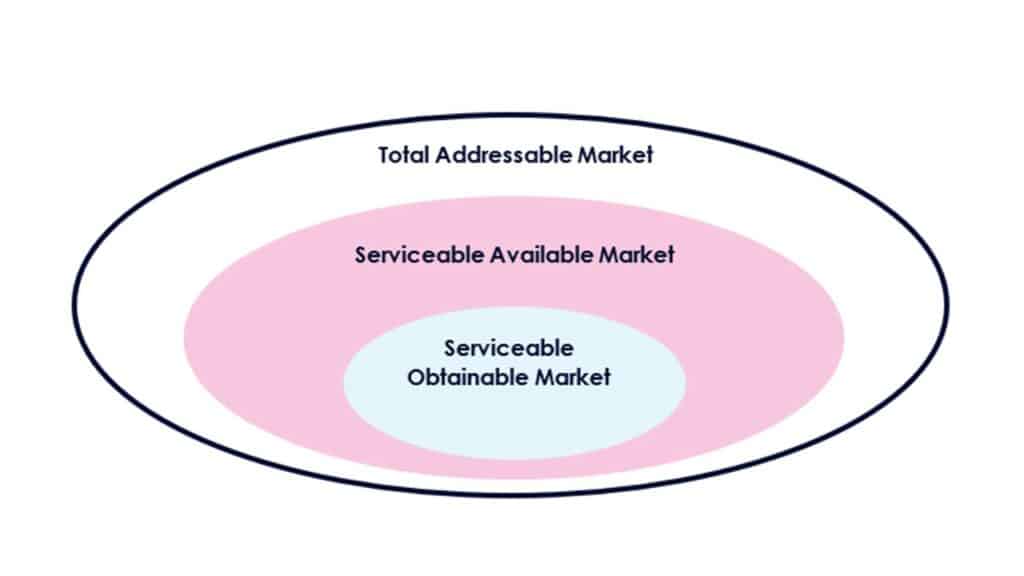

A GTM plan typically begins with defining your addressable market. So, let’s start with some basics.

What is the ‘Total Addressable Market’ (TAM)?

Simply put, the Addressable Market (aka. Available Market) is total market demand for your product or service – including the portions you cannot (yet) serve.

This metric is calculated in annual revenue, supported by unit sales figures, and is used to help establish the viability of your business. You need to define this credibly in order to convince Funds that not only an opportunity exists in the market – new or otherwise – but that you also have a robust plan to exploit it, once growth Capital is made available, based upon your track record to date.

When discussing TAM, we need to define 2 more metrics: the Serviceable Available Market (SAM) – the portion of TAM that have an appetite for your solution – and the Serviceable Obtainable Market (SOM) – the market share you are currently able to serve.

Calculating TAM

There are multiple ways of calculating TAM. We recommend using more than one method and compare the results for better accuracy and smart numbers instead of guesses.

Method 1: Bottom-up, using historic data

TAM = Total Number of Accounts x Average Contract Value

One way to calculate TAM is to carry out an analysis of the sector, determining the total number of (potential) customers and multiply it by your average deal size based on historic data. This will give you the value of the total market opportunity, if there were no competitors.

Method 2: Top-down, using industry research and reports

This approach relies on educated guessing based on information publicly obtainable of the market, hence dependant on the accuracy of said data. Yet, it can be useful for young businesses at the beginning of their funding journey when little data of your own is available, or to benchmark it against your alternative calculations.

In addition, finding out what is the revenue of the other suppliers to your market is a solid basis, although this data is often not readily available unfortunately.

Competitors raising Funding is also another encouraging statistic and such raises are often supported by their research on market size, etc.

Method 3: Value-theory

This method is particularly useful for scaleups looking to expand, for example by adding new features or upgrades. It is built on the estimated value your product can provide to users and how you will capture it through value-based pricing. For this method, you will need to understand your customers and know what they find valuable, and even more importantly their willingness to pay for it.

Competitiveness

In addition, you should be acknowledging the need – and how you will address it – to retain your superior competitiveness, appreciating that your competition will not be ‘standing still’ either.

Key Questions

Here are some key questions about your TAM you should aim to clarify in the process to get the most reliable results:

- Its size (?), geographic location and industry sector/vertical markets

- The number of buying organisations and clients (including the roles of the buying decision-makers) in each

- Getting leads – your lead gen program; self-service etc

- The buying process (e.g. tenders)

- The typical deal size, and the split between software and maintenance

- Length and type of sales cycles (e.g. one-time or land & expand)

- The number of new deals forecasted in a year and the split between new-logo and existing clients, taking into account trends historically

- The growth-rate forecast – reconciling that with the historic trends

- Retention rates – are your customers increasing their spend or instead dropping off?

- How all of the above translates into Total Contract Value – TCV; Recognised Revenue; Annual Recurring Revenue- ARR and finally Cash!

Summary

The most important factor in a funding round is to gain acceptance by prospective backers that a greater opportunity does exist in the market than you are currently able to take advantage of with your existing resources – and that your track record gives them the confidence that you can execute at a much higher scale than you have been able to do so, so far.

Existence of a ‘record sales pipeline’ considerably bolsters such confidence as does a successful conversion rate historically of such opportunities

Clearly and credibly presenting your Go to Market strategy will show potential funders that

- you understand the market

- the competitiveness of your proposition and

- have a clear strategy to exploit the market opportunity, supported by your track record

ultimately making your business an attractive investment.

We at ScaleUp Group have invested considerably in Templates and Models to capture the essence of a GTM strategy for the benefit of our Clients.

We hope this article has whetted your appetite and ensures your pitch is not ‘still born’!