Author: John O’Connell Founder & Executive Chairman ScaleUp Group

Our recent survey reveals that the vast majority of tech. companies raising Series A funding of between £2m and £5m ‘do it themselves’ i.e. do not use a specialised adviser.

This is despite the fact that Funds are being as picky as ever at this level – according to Silverpeak the number of such deals has not changed from 2020 to 2021 (even though there has been a doubling of deals above £5m) – meaning the abysmal, less than 1% success, rates of entrepreneurs trying to raise cash at this level is not improving.

Scrambling to obtain funding, it is understandable that entrepreneurs slide into a pitfall – which is they become receptive to taking the first offer that comes along – assuming they get an offer at all.

2021

Beauhurst tells us that there were approx 90 Series A deals falling into the £2m- £5m category in UK tech last year amounting to £280m approx. That was only c.10% of the £2.7 billion value of deals, Silverpeak classes as Series A now – with an average deal value of £16 million, meaning more cash is going to larger businesses.

Such businesses can afford to have advisers – but the need for specialist advice is as great or greater when raising less cash because mistakes made then are compounded over time and can last forever. George Windsor of TechNation suggests that the focus should switch to helping the “misunderstood, poorly-assessed middle ground that gets the least attention” which he defines as scaling companies with between 50 – 100 employees that are raising Series A rounds.

Our straw poll of entrepreneurs tells us that few spend much if any time conducting any form of process to entice as many funds as possible to bid for investment in their company. In fact, advisers like ScaleUp Group were used only 10% of the time. By not creating the necessary competitive tensions, an entrepreneur weakens their negotiating position, resulting in sub-optimal valuations and terms etc.

I question the wisdom of not obtaining the best valuation & terms at this pivotal stage of your business. The hidden cost of not doing so can run into £ millions (see below).

This cost is hidden because it only crystallizes on a once-in-a-lifetime exit event when is too late to do anything about it.

So what is the problem?

It is very likely that quite a number, probably the majority, of entrepreneurs could have done better – running into £ millions – by conducting a proper fund raising process.

At the £2m-£5m raise level, most entrepreneurs’ business plans are rejected by the majority of funds. So if they are undeterred, they have to go on a tiresome and draining milk round of multiple sessions with multiple funds to try to secure a deal at any price.

Entrepreneurs are not normally attuned to the world of investors. Instead, understandably they want to get their capital for growth as quickly and as ‘cheaply’ as possible, so that they can get on with leading their business, seizing the proverbial window of opportunity.

Funds on the other side of the table, human nature being what it is, do not have to try so hard with the terms they offer if they have little or no competition. But with competition inevitably pencils will be sharpened in deal-making parlance i.e. entrepreneurs have a much better chance of receiving a valuation involving less dilution of your precious equity.

So we often have the situation of frustrated, time-starved, cash-hungry entrepreneurs negotiating with investor-savvy Fund managers, without any competition. Unsurprisingly, lopsided deals in the favour of the Fund can be the result.

So what might that cost be?

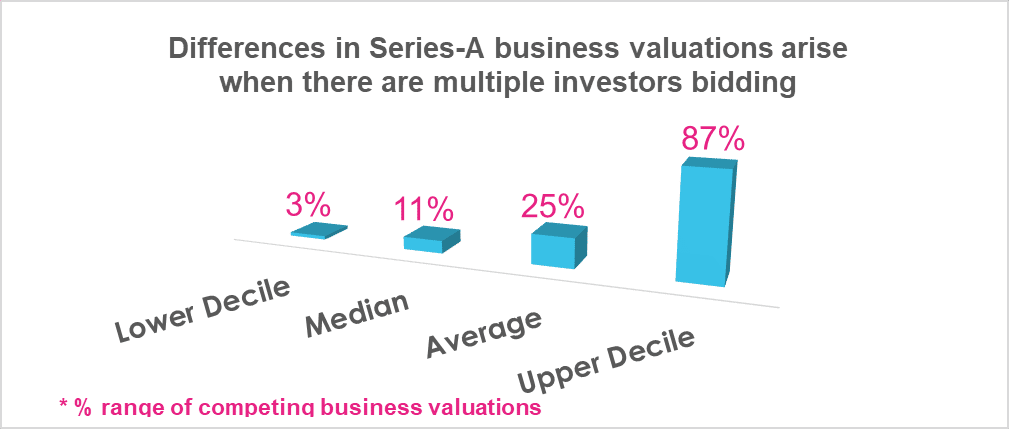

Our analysis this month of some of the deals we completed for our clients, going back almost 5 years to only a couple of months ago, shows that they received offers with a wide range of valuations, as follows:-

- The percentage of their business to be owned by a Fund varied by 25% on average.

- The variation in valuations ranged from a low of 3% to a high of 87%. (See chart below)

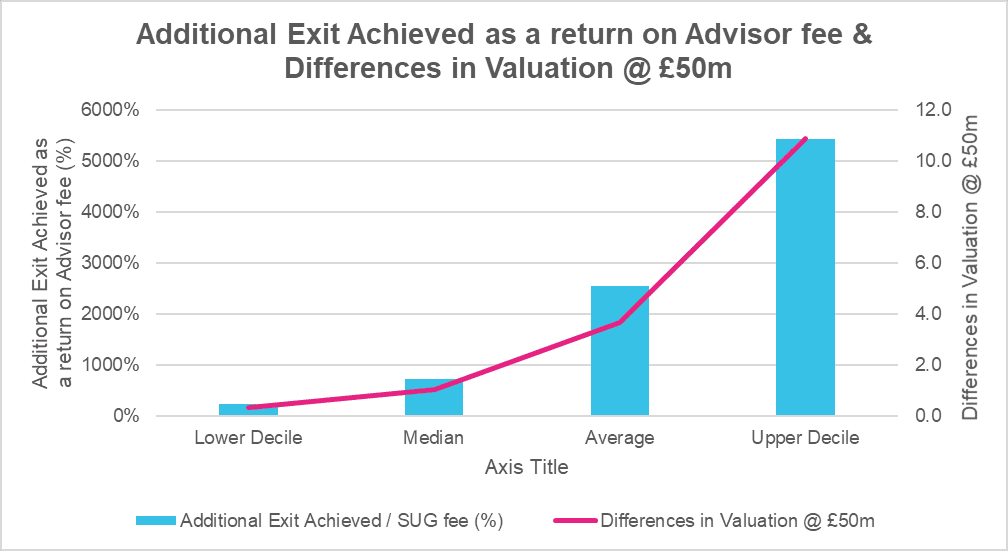

The cost to the founders is when the business is sold in due course – for let’s say £50 million – which could have been up to £11 million, with the average being approx. £4 million. (Needless to say, we at ScaleUp Group made sure that did not happen in practice, but it could have if an entrepreneur had been unlucky enough to have had only one of these inferior offers to consider.)

For completeness, it should be said that there is more to Funding offers than simply the headline valuation. The inclusion of downside protection clauses and if there are participating or non-participating preference rights can make any comparisons less clear. For instance, a valuation with participating rights attached to the new equity can swing valuations enormously too. Such ‘clever’ terms require careful assessment so calculating the Waterfall is the best way of helping our clients decide, we find.

Other considerations when weighing up the ‘DIY’ approach from the one guided by an Adviser, apart from the terms, is

- the certainty of our clients receiving offers at all; and

- the efficiency of our process which includes setting up sessions only with well qualified funds in the first place – focus; cheque size etc.

Other ‘softer’ considerations include:-

- experience of the behaviour of a fund, in both good and challenging circumstances – such as, would they invest again in a downturn/pandemic etc.?

- the seniority of their proposed representative – this is important in a multi-year relationship when you want someone sitting at your board table who will not have to check every variation to your plans for instance, with their bosses

- the Funds added value –in terms of market sector knowledge and connections

- and of course, the chemistry fit between the parties

Summary

- Raising Series A funding is a significant challenge beyond what will have been experienced when obtaining capital from family & friends and/or Angels.

- A process of doing it efficiently, speedily and getting the right valuation and terms, from the most appropriate fund is what ScaleUp Group specialises in.

- On a purely financial basis:-

- on average our clients received an extra £4 million on a £50m exit, but up to £11 million more (the difference would increase at higher exits of course)

- Subsequent fund raising rounds would also be less dilutive as a consequence

I hope this article helps to explain why more entrepreneurs looking for Series A funding, especially at the £2m- £5m level, should be using the support of Advisers such as ourselves and by so doing will not be leaving £millions on the table!